Tuesday, December 13, 2022

Sunday, December 4, 2022

Top Benefits of Working With a Professional Tax Preparer

It is almost that hair-pulling, stress-inducing time of the year again, tax time. This leads to the inevitable next issue of whether to try one of the many DIY tax software programs available or have the taxes done by a professional tax preparer. While there are many more tax software options than ever before, there are still some critical reasons to trust a tax preparation professional to prepare taxes, explains Greg J. Menia, CPA and founder of Accurate Tax and Bookkeeping Services.

Doing taxes is a daunting task, and one most people want to avoid as much as possible. This is one reason why some people opt to try DIY tax preparation software. Many of these programs are very low-cost and simple to use. But is this the best option? For the few individuals that have simple taxes and some level of experience, it may yield an adequate outcome. For most, however, it can lead to costly mistakes.

.jpg)

There’s No Substitute for Tax Knowledge

Tax software, like any other software program, relies on the correct input. The software may be advanced enough to anticipate some information and provide prompts, but it is still not a substitute for human knowledge and expertise. A tax preparation expert does not just input information, they evaluate it. Because they have knowledge of tax laws and have in-depth experience in working with real-life tax issues, tax accountants avoid costly mistakes and get more money back than any common software can.

Tax Experts Use Better Software

One of the first benefits of working with a CPA for tax preparation is that professionals use expert programs that are not available to the general public. For comparison, there are many tax preparation programs available from as low as $10 to $200. Professional software programs can cost as much as $6,000 or more. The powerful software allows the accountant to evaluate the data, line items, and organization to ensure all the information is complete and correct. Better tax tools yield better results.

It Avoids Mistakes

Mistakes in taxes can be very costly. It might mean missing significant deductions, or worse, triggering a costly, stressful, and time-consuming IRS audit. An accountant can help avoid these errors and help avoid being flagged for an IRS audit.

Tax Professionals Can Help All Year

An accountant can do much more than just prepare taxes once each year. They can help clients work all year to make smart choices that will benefit them at tax time. Software is purely for getting taxes done. An accountant knows you, and your individual situation such as your job, children, expenses, education, and more. A knowledgeable professional can help make important recommendations such as smart business purchases or how to save for education.

A Tax Professional Saves Time and Money

When a person uses inexpensive tax software, it leaves a lot of room for things to go wrong. If it does go wrong, it means needing to hire a CPA to assess and handle the problem. All of this is time, money, and a lot of added stress that could have been avoided. Taxes are serious and complicated. Doing them wrong can have serious consequences. Overall, a tax professional can save time and money.

Accurate Tax & Bookkeeping Services

Founded by Greg Menia, CPA, Accurate Tax & Bookkeeping Services, LLC (ATBS) is a full-service tax, accounting, and consulting firm located in Brandon, FL, offering services to businesses and individuals in Tampa Bay and surrounding cities. ATBS specializes in tax preparation and planning, accounting and bookkeeping, payroll, and representation in IRS/State matters. For more information about tax preparation or other services, call (813) 655-9702.

.jpg)

710 Oakfield Dr.

Ste 125

Brandon, FL 33511

Monday, November 7, 2022

Thursday, October 27, 2022

Brandon Expert Shares Top Reasons to Hire a Professional for Business Taxes

Between managing a team, marketing, sales, strategy, and daily operations small business owners wear a lot of hats. One area that the SMB should consider outsourcing first, however, is tax preparation. Hiring tax services for a small business is a smart move that can translate into better business profitability and a lot less headache, explains Greg Menia, CPA and founder of Accurate Tax & Bookkeeping Services, a full-service tax, accounting, and consulting firm located in Brandon and offering services to businesses and individuals throughout the Tampa Bay area.

What is a Tax Preparation Service?

More than a tax advisor, a tax professional is someone with in-depth tax knowledge, advanced credentials, and industry experience to assist a small business with tax services. Most tax preparation services include preparing, filing, or assisting with business tax forms. Beyond these basic services, a tax preparer with appropriate credentials can also defend a taxpayer with the IRS. This includes audits and tax court issues.

Advantages of Hiring a Tax Preparation Service

For small businesses, hiring a tax professional provides many benefits, not just during tax time. Here are a few of the most important advantages to small businesses.

- Having business taxes done by a professional helps business owners avoid costly mistakes.

- Tax professionals can answer questions about difficult-to-understand tax codes and help resolve tax issues.

- Tax professionals can provide tax planning services and advise business owners of smart money moves to make throughout the year.

- Tax professionals can help provide long-range strategies for reducing their taxes.

- Utilizing a tax preparation service frees up the business owner’s time to focus on core duties and revenue-generating activities.

- Tax Services for small businesses can review past tax returns to ensure they were filed accurately.

- Using a tax professional helps reduce the risk of an audit. If the business is audited, the tax professional may be able to represent the client.

How to Find Tax Services for Small Businesses in Brandon

Not all tax preparers are created equal, and not every tax preparation service is the perfect fit for every business. The key to finding a good fit is asking a lot of the right questions.

- Do you have a PTIN (preparer tax identification number)? Anyone who prepares federal tax returns for compensation must have a valid PTIN to legally be able to prepare taxes.

- What are your qualifications? There is a wide range of people that can prepare taxes, but that doesn’t necessarily make them a good fit for your business.

- Do you have experience in my industry?

- Who will be the person preparing my taxes?

- What additional services do you provide?

- What are your fees?

- Who will sign my return? A preparer without a PTIN will not sign the paperwork, and this is a sign you should keep looking.

- Do you offer electronic filing?

- Are you available for questions even outside of tax season?

- What happens if I get audited? Can you represent me?

A tax professional can help by preparing taxes, but the right service can help all year with services such as tax planning, bookkeeping, accounting, and consulting. By asking comprehensive questions, the small business owner can identify an experienced professional.

Accurate Tax & Bookkeeping Services

Accurate Tax & Bookkeeping Services, LLC (ATBS) is a full-service tax, accounting, and consulting firm located in Brandon, offering services to businesses and individuals throughout the Tampa Bay area. Areas of expertise include tax preparation and planning, accounting and bookkeeping, payroll, and representation in IRS/State matters. For more information about bookkeeping or other services, call (813) 655-9702.

Accurate Tax & Bookkeeping Services

710 Oakfield Dr.

Ste 125

Brandon, FL 33511

Friday, October 7, 2022

Thursday, September 15, 2022

Wednesday, August 31, 2022

Accurate Tax & Bookkeeping: Penalties When Taxes Are Filed Late

What happens when taxes are filed late?

Although it may be tempting to evade tax payments, it is not advisable to do so. The IRS (Internal Revenue Service) takes action against tax-evaders. The interest and penalties on the outstanding amounts will accrue over time when taxes are not paid by the due date. Even though most people are aware of these facts, there may be situations when they file their taxes late or do not pay them at all. Hence, it is imperative to know the consequences of not filing taxes. Accurate Tax & Bookkeeping enlists the same below:

1. Failure to file penalty

If the tax return has not been filed by the deadline, the IRS can impose a penalty. This is the “failure to file penalty”. This penalty depends upon the amount of unpaid taxes and also on how long the filing of taxes has been delayed.

2. Late Payment Penalty

This is the penalty a taxpayer incurs for not paying the total tax amount owed by the due date.

3. Lost Tax Refunds

Taxpayers must file tax returns within three years of the deadline. If not, they generally will forfeit any refund the IRS owes them.

4. Statute of limitations

The IRS generally has the power to audit the tax returns filed by a taxpayer within the last 3 years. This period can be longer under certain circumstances. This is called the “statute of limitations”. If the IRS suspects that the taxable income filed has been understated, an audit can be conducted, which may lead to further penalties and legal actions.

5. Penalty abatement

Penalty abatement refers to the process of removing penalties for the taxpayers. This is done when the taxpayer has made a mistake while filing the tax or has faced an uncommon circumstance such as a natural disaster, serious illness, or death of a family member. The IRS may also waive the penalty if the taxpayer pays taxes on time, has filed all tax returns, and has no prior penalties within the last 3 years.

6. Pay in installments

A taxpayer can set up an IRS installment agreement which gives them up to six years to pay their tax liability.

If a large amount of time passes since the tax deadline and it has not been paid, the IRS could potentially seize a portion of the taxpayer’s wages until the amount owed is settled. Also, the IRS may file a return on the taxpayer’s behalf. This is called “substitute for return” (SFR). SFR can end up being larger than the original tax amount to be paid.

Having said all this, the bottom line is paying taxes on time is the best way to maintain a healthy financial record. A good tax preparer can provide the necessary advice and guidance in this regard.

About ATBS

Working closely with small businesses and individuals, Accurate Tax & Bookkeeping Services is a tax preparation and bookkeeping service company founded in 2010 by Greg J. Menia. The team has expertise in the fields of tax preparation and planning, accounting and bookkeeping, payroll, and IRS/State representation around Tampa, FL.

To contact Greg and the team at Accurate Tax & Bookkeeping Services today:

- Call (813) 655-9702 in Brandon, Florida.

- Or Email greg@brandonaccountant.com

Or visit the offices at 710 Oakfield Dr. Suite 159, Brandon, FL 33511.

Tuesday, August 23, 2022

Friday, July 29, 2022

Poor Bookkeeping Can Negatively Impact Small Businesses

7 Consequences of Poor Bookkeeping

Accurate bookkeeping is indispensable for business owners as it offers the foundation on which business owners make financial and organizational decisions such as taking loans, hiring new employees, investing in new assets, and paying taxes. Accurate Tax & Bookkeeping, a bookkeeping and tax filing service, lists down how poor bookkeeping can harm small businesses.

.jpg)

1. Expenses

A poor categorization of expenses such as business and personal can land a business in a lot of trouble during tax filing. Moreover, when all the expenses are not recorded, business owners cannot determine and anticipate their year-round spending pattern. A shortage in supply and production can derail the business goals and lead to a loss of revenue and reputation.

2. Revenue

Bookkeeping mistakes may include misinformation on revenues, investments, rental income, and other income sources. A wrong record of the income can land a business in the bad books of the IRS and the state as well as the federal government.

3. Debts

Businesses work with a lot of creditors and money lenders. Disorganized bookkeeping can make businesses lose track of their payments due to creditors, which can impact the credibility and reputation of the business. These late payments can further jeopardize the business’ ability to obtain credit, lead to higher interest rates, and reduce the credit score of the company.

4. Budgeting

When revenues, expenses, and debts are unclear, the business owners remain unclear about the company’s financial performance. This does not allow them to create adequate budgets or prevent financial crises. An effective accounting system on the other hand will include budget variance analyses to understand if business goals are being met or if the management needs to change the course of action.

5. Banking

Overdraft fees, late payments, and account closure are some of the byproducts of poor bookkeeping that businesses may face. When commercial banking records are mishandled, the business can run into trouble with banks as well.

6. Errors and fraud

When a business has a robust accounting system in place, the chances of errors and fraud reduce drastically. Moreover, internal audits and external audits help businesses maintain accurate records.

7. Tax filing issues

When the books are maintained accurately and across the year, tax filing becomes a breeze. If not, businesses tend to lose track of their tax obligations and end up paying huge penalties for late or inaccurate taxes. Depending upon the type of business, tax filing may be needed quarterly and monthly as well besides the annual income tax. Moreover, a clear bookkeeping practice also allows businesses to make effective tax strategies that save them a lot of money.

Investing in a reliable bookkeeping service or hiring an in-house bookkeeper is necessary for businesses to stay afloat, thrive, and stay away from tax troubles. Businesses can contact Accurate Tax & Bookkeeping to take care of their bookkeeping and maintain their peace of mind.

.jpg)

About ATBS

Specializing in handling the financial needs of businesses of all sizes, Accurate Tax & Bookkeeping Services is a tax preparation and bookkeeping service company founded in 2010 by Greg J. Menia. The team performs tax services for small businesses and large businesses alike, serving all areas around Tampa, FL.

Call (813) 655-9702 today for “accountants near me” in Brandon, Florida. Alternatively, contact Greg and the team at Accurate Tax & Bookkeeping Services by emailing greg@brandonaccountant.com or visiting the offices at 710 Oakfield Dr. Suite 159, Brandon, FL 33511.

Monday, July 11, 2022

Friday, June 24, 2022

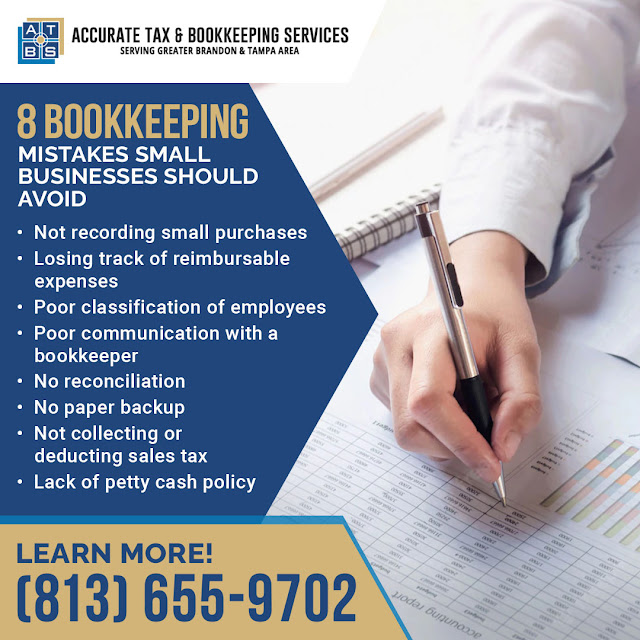

The Bookkeeping Mistakes Small Businesses Often Make

8 bookkeeping mistakes small businesses should avoid

Accurate bookkeeping requires consistency and experience, which a business and its team may not possess. Even with an in-house bookkeeper, certain mistakes still occur due to a simple lack of awareness about what is important and what isn’t for bookkeeping and tax filing. Accurate Tax & Bookkeeping Services discusses the common errors businesses make while preparing their books and how they can impact them.

-

Not recording small purchases

Every small purchase that a business makes can slowly add up to a significant amount that can get overlooked if not recorded. Saving receipts of purchases below $75 is also necessary to present during an audit, while some of these purchases can be used to claim tax deductions during tax filing. Businesses can use online and digital accounting programs or third-party apps to store a digital copy of the receipt.

-

Losing track of reimbursable expenses

Keeping track of reimbursable expenses is important to keep track of the business's financial health, to enable tax deduction claims, and to have a clear paper trail available for auditors. It is important to keep track of these expenses and keep the record up to date.

-

Poor classification of employees

Misclassifying employees such as independent contractors, consultants, and freelancers is an invitation to an audit. An accountant must be consulted to correctly classify employees and avoid unpleasant surprises such as penalties and lawsuits during tax filing.

-

Poor communication with a bookkeeper

Sometimes business owners make decisions that impact finances and accounting but forget to communicate them to the bookkeeper. For instance, outsourcing work to a professional or buying supplies and not informing the bookkeeper about these decisions and associated costs will lead to errors in the books.

-

No reconciliation

To keep a constant eye on the business's financial health, it is important to reconcile the books with the bank statements consistently. This reconciliation helps business owners understand the cash flow and catch bank errors before they spiral into big mistakes. To ensure an accurate reconciliation, businesses can hire a bookkeeper to manage this complex task.

-

No paper backup

Digitization has made documentation easy, but it is important to keep a backup of the papers. Why? Firstly, it is important to have a paper backup in case of a technical glitch. Secondly, the taxing authorities may want to see the paper trail of all transactions. Businesses should ideally keep a backup of the financials for at least seven years.

-

Not collecting or deducting sales tax

Businesses, especially eCommerce businesses, often fail to deduct sales tax from the total sales. This leads to substantial tax burdens during tax time. Moreover, constant changes in laws regarding sales tax for online businesses in different states must be tracked by an experienced bookkeeper to ensure compliance.

-

Lack of petty cash policy

Creating a petty cash policy, designating a petty cash custodian, and keeping track of petty cash receipts are important for businesses to stay out of trouble. A custodian ensures accountability and mitigates the risk of theft or fraud. A receipt for documentation must accompany every purchase. After purchase, the receipts and remaining petty cash should equal the original dollar amount designated to the fund. Once the fund is over, a check can be written to cash to reset the original petty cash amount.

To ensure that a business’s books are accurate and up to date, business owners can contact professional bookkeeping services such as Accurate Tax & Bookkeeping Services.

About ATBS

Accurate Tax & Bookkeeping Services specializes in handling financial needs for businesses of all sizes.

Greg J. Menia founded the tax preparation service company in 2010, having worked in business tax services since 1995. The team performs tax services for small businesses and large businesses alike, serving all areas around Tampa, FL.

Call (813) 655-9702 today for “accountants near me” in Brandon, Florida. Alternatively, contact Greg and the team at Accurate Tax & Bookkeeping Services by emailing greg@brandonaccountant.com or visiting the offices at 710 Oakfield Dr. Suite 159, Brandon, FL 33511.

Friday, June 3, 2022

Friday, May 20, 2022

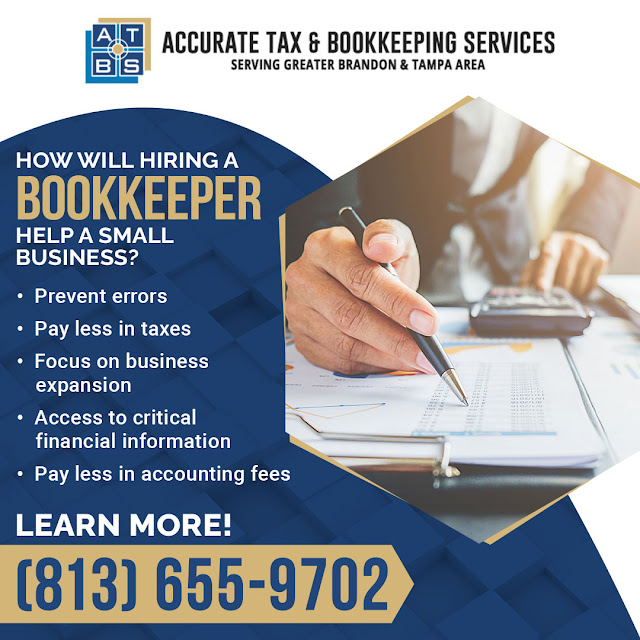

The Benefits of Hiring a Bookkeeper for Small Businesses

Benefits of working with a bookkeeper

A new business usually requires minimal bookkeeping and can be managed by maintaining a simple spreadsheet. However, as a business expands, the business owners will struggle to keep the books accurately. Accurate Tax & Bookkeeping, a tax preparation service, lists the signs that a small business needs a bookkeeper and the benefits of hiring one.

Signs a business needs a bookkeeper:

- If the books are never up to date

- If the sales have increased but not the profits

- If the cash flow is unpredictable

- If the DIY bookkeeping takes more time than can be afforded

How will hiring a bookkeeper help a small business?

-

Prevent errors

A lack of experience and excess bookkeeping tasks can overwhelm a business owner whose core skill is not bookkeeping. Mistakes such as data entry errors, missing entries, double entries, and mixing personal and business expenses can make tax filing a nightmare. Business owners can ensure that their expanding business accounts are error-free by hiring a professional.

-

Pay less in taxes

An experienced bookkeeper can quickly identify the ordinary business expenses tax-deductible in a particular industry. Moreover, the cost of hiring a bookkeeper is also tax-deductible.

-

Focus on business expansion

When business owners have to spend a majority of their time on keeping the books error-free, they cannot invest time in achieving their core business objectives. Business owners need to invest time in networking, marketing, managing, purchasing and supplying, selling, and communications to pursue business expansion.

When bookkeepers take over the tax filing and bookkeeping tasks, business owners can be assured that their books are in the right hands while investing their time in jobs worth their money. A survey shows that, on average, companies’ profits increase 16% after they hire bookkeepers.

-

Access to critical financial information

A bookkeeper can show a business owner the accurate financial picture of the company. When a bookkeeper keeps track of the expenses and profits, business owners can discern their budgets and spending. Any confusion regarding the books can be instantly clarified when businesses work with a bookkeeper.

-

Pay less in accounting fees

When business owners cannot manage the monthly financial statements across the year, they are forced to hire an accountant to file taxes. This would require an accountant to prepare a report for the year. This is a bookkeeper’s task for which a small business will end up paying substantially much more to an accountant.

Therefore, hiring a bookkeeper at the beginning of the financial year ensures there are no last-minute expenses to manage the books and file taxes.

With a bookkeeping service like Accurate Tax & Bookkeeping, small businesses can save a lot of time, money, and stress when the tax filing season arrives. The accuracy with which a bookkeeper will operate will ensure that business owners can focus on business expansion and profits instead of filing taxes.

About ATBS

Accurate Tax & Bookkeeping Services specializes in handling financial needs for businesses of all sizes.

Greg J. Menia founded the tax preparation service company in 2010, having worked in business tax services since 1995. The team performs tax services for small businesses and large businesses alike, serving all areas around Tampa, FL.

Call (813) 655-9702 today for “accountants near me” in Brandon, Florida. Alternatively, contact Greg and the team at Accurate Tax & Bookkeeping Services by emailing greg@brandonaccountant.com or visiting the offices at 710 Oakfield Dr. Suite 159, Brandon, FL 33511.

Wednesday, May 11, 2022

Monday, May 2, 2022

Demystify Some of The Important Tax Deductions For Small Businesses

Important tax deductions for small businesses

Every small business owner who has raced against time to file taxes or struggled with tax credits and deductions knows taxes are a complicated matter. Irrespective of the complexity, it is crucial to take out the time to leverage all the right deductions to save thousands of dollars each year. Accurate Tax & Bookkeeping, a tax preparation service, breaks down some tax deductions that small businesses must not miss out on.

-

Educational expenses

Training and upgrading skills is a necessity for the growth of a business and sometimes it is a legal requirement for some businesses. The expenses borne by a small business to upgrade its employees’ skills and knowledge through seminars, workshops, and other means can be leveraged. These expenses that are directly related to a business are tax-deductible.

-

Regulatory and licensing fees

Businesses that require state and local permits, licenses, and other regulatory documentation or practices are necessary business expenses that are tax-deductible.

-

Home office costs

Whether it is a stand-alone space or a home, small businesses operating out of either can take advantage of deductions such as rent, utility bills, insurance, and painting & repairs. However, businesses operating out of homes need to meet certain criteria as per the IRS documentation. One of the requirements is that the office space must be used exclusively for work only. Secondly, this space must be the primary place of business.

-

Wireless phone service bills

Cell phones are the main and popular means of communication for most businesses. While many businesses may invest in another phone number dedicated to business purposes, others may continue using their phones for business calls. Despite this overlap of business and personal usage, businesses can still deduct a portion of the cost on their business taxes.

-

Petty cash purchases

Unplanned and minor expenses such as a few coffees for a morning meeting or an out-of-cycle purchase can slowly add up to substantial amounts over a year. Such purchases are often made using petty cash, traditionally stored in a till but now these expenses can be conveniently made using “petty cash” cards. These expenses are deductible if the receipts are saved.

-

Professional & consultant expenses

Necessary expenses such as fees paid to lawyers, tax professionals, or consultants generally can be deducted in the year they are incurred. However, if the work relates to future years, the expenses must be deducted over the life of the benefit received from the lawyer or other professionals.

-

Automobile expenses

Deductions on mileage and gas expenses are a well-known fact. However, many small business owners fail to deduct things like maintenance, registration, tolls, and parking fees. Keeping track of such related expenses incurred to travel for business can help in substantial deductions.

A solid documentation system or diligently storing the receipts and saving transactional information of expenses can make tax preparation a breeze later in the year. Businesses can consult with tax preparation services such as Accurate Tax & Bookkeeping to determine what receipts and documentation are worth keeping.

About ATBS

Accurate Tax & Bookkeeping Services specializes in handling financial needs for businesses of all sizes.

Greg J. Menia founded the tax preparation service company in 2010, having worked in business tax services since 1995. The team performs tax services for small businesses and large businesses alike, serving all areas around Tampa, FL.

Call (813) 655-9702 today for “accountants near me” in Brandon, Florida. Alternatively, contact Greg and the team at Accurate Tax & Bookkeeping Services by emailing greg@brandonaccountant.com or visiting the offices at 710 Oakfield Dr. Suite 159, Brandon, FL 33511.

Friday, April 22, 2022

Friday, March 18, 2022

Accurate Tax & Bookkeeping Shares Smart Tax-filing Tips For Small Businesses

Smart tax-filing tips for small business owners

Tax preparation and filing can give several sleepless nights to small business owners who have been too preoccupied with their core business to sort out their tax issues. It is understandable. But there is no hiding from taxes. Accurate Tax & Bookkeeping shares some great tips that can help small business owners stay organized throughout the year when it comes to taxes.

1. Be consistently organized

That last moment collection of data when the tax filing deadline is looming overhead often leads to inaccurate or incomplete results besides causing immense stress. Sounds familiar? Small businesses can avoid such situations by staying organized across the year. Being consistently careful by maintaining a separate file for taxes and digital categorization of income and expenses can make tax filing a stress-free event. Consistency and organization are key.

2. Record revenues and expenses

Sorting through the pile-up of revenue and expense data at the year’s end can be frustrating and inefficient. Keeping a clear record of revenues and expenses on a daily/weekly basis with the help of a software or an accountant not only makes tax filing a seamless process but also helps streamline the business. The constant data input of business cash flow and net income/loss can make a difference to the way a business is managed.

3. Regular checkpoints

Get rid of the unpleasant surprises at the end of the year by proactively maintaining all tax-related matters across the year. This regular check-in not only allows business owners to understand key performance indicators but also breaks up tax preparation activities into smaller and manageable chunks.

4. Delegate

Small business owners always have their plates full. Focusing on core services becomes imperative to expand and grow. But at the same time tax matters cannot wait for other matters to get resolved. Therefore it is a wise decision to delegate the tax matters. Especially with any tax law changes, it's critical to work with a CPA and adopt the best business structuring strategies based on accurate calculations.

5. Financial planning meets tax planning

Business owners should make taxes part of their financial planning. It helps reduce a business’s tax liabilities and optimally utilizes tax exemptions, tax rebates, and benefits as much as possible. By regularly checking if the records are up to date, and meeting planners to ensure all possible tax reductions have been applied, business owners can file their taxes without any stress and confusion.

6. Leverage specific tools

Technology is a blessing. Business owners can use various free or economical tools to organize and auto-code their business transactions and simply share this electronic data with their accountants. There is no need to sift through old documents at the last moment. This little step at the beginning of the year will make the year-end peaceful and stress-free.

7. Track expenses weekly

Small business owners must make time to balance and track their expenses. This weekly check will help them stay alert about their tax liabilities and protect them from any penalties from the IRS. Keeping personal and business expenses separate is crucial.

About ATBS

Accurate Tax & Bookkeeping Services specializes in handling financial needs for businesses of all sizes.

Greg J. Menia founded the tax preparation service company in 2010, having worked in business tax services since 1995. The team performs tax services for small businesses and large businesses alike, serving all areas around Tampa, FL.

Call (813) 655-9702 today for “accountants near me” in Brandon, Florida. Alternatively, contact Greg and the team at Accurate Tax & Bookkeeping Services by emailing greg@brandonaccountant.com or visiting the offices at 710 Oakfield Dr. Suite 159, Brandon, FL 33511.

.jpg)

.jpg)